Global share markets mostly fell over the last week with further rate hikes and ongoing concerns about US banks and the US debt ceiling. Despite strong rallies on Friday as US banks bounced and as solid US payrolls tempered recession fears a bit, for the week US shares lost 0.8% and Eurozone shares fell 0.5%. Chinese shares fell 0.3% and Japanese shares rose 1%. Australian shares fell by another 1.2% not helped by the surprise RBA rate hike and the weak global lead with financials, resources and telcos leading the falls. Bond yields were mixed and little changed. Oil and iron ore prices fell but metal prices were flat. The $A rose though as the $US fell.

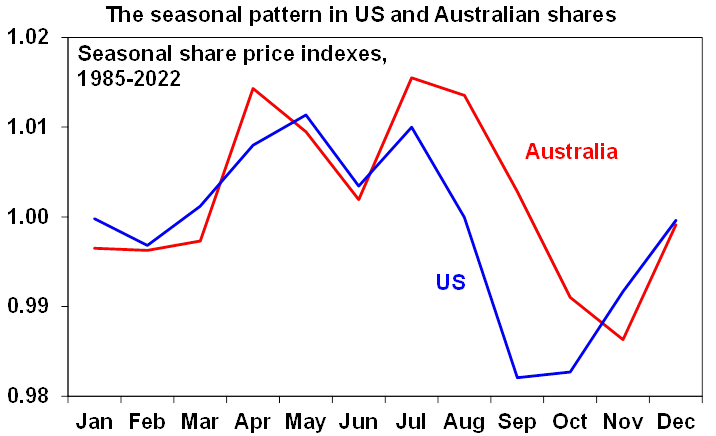

Sell in May and go away? Shares entering a rougher patch. After a strong start to the year – supported by hopes that rates will soon peak enabling a soft landing and better than feared profits – shares are increasingly vulnerable to a rough patch ahead. While the Fed is toning down its hawkishness – it along with the ECB and RBA continued to raise interest rates over the last week adding to recession risks. This is despite ongoing issues with banking stress in the US. Meanwhile the US debt ceiling issue is hotting up with Treasury Secretary Yellen putting the X date as early June with a last minute solution and cuts to government spending looking very likely – both of which will worry share markets as in 2011 and 2013. The period from May to September is often rough for shares. And while China’s economy is continuing to recover its increasingly looking focussed on the services sector and so is less commodity intensive (evident in a fall in the iron ore prices below $US100 a tonne) than we thought might have been the case which is an additional potential drag for Australian shares.

Source: Bloomberg, AMP

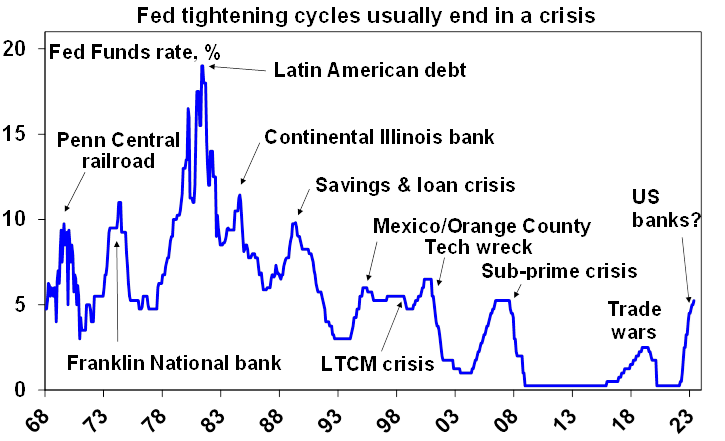

Are central banks going too far? A big factor in central bank thinking should be ongoing US banking stress. While the takeover of First Republic Bank by JP Morgan went smoothly with depositors protected, it and the prior “rescues” leave three big issues unresolved and festering away. First, its unclear how the US Government can pay for the deposit protections etc running the risk that Congress will get involved. Second, and far more importantly its adding pressure on other banks to be more cautious in their lending to avoid going the same way, with Powell noting that the banking stresses “appear to be resulting in even tighter credit conditions.” Second, the rescues wiped out shareholders which is now making shareholders in other regional banks increasingly wary fearing they may be wiped out too – putting downwards pressure on their share prices. This in turn spreads the crisis to other banks as depositors notice falling share prices and withdraw their deposits. All of which adds to the additional defacto monetary tightening now underway increasing the risk of recession. So its unusual to see the Fed continuing to raise rates despite this as after past crises it stopped. Similarly, its dangerous to see other central banks – like the ECB and RBA – not being more wary of this given the influence of the US economy globally.

Source: Bloomberg, AMP

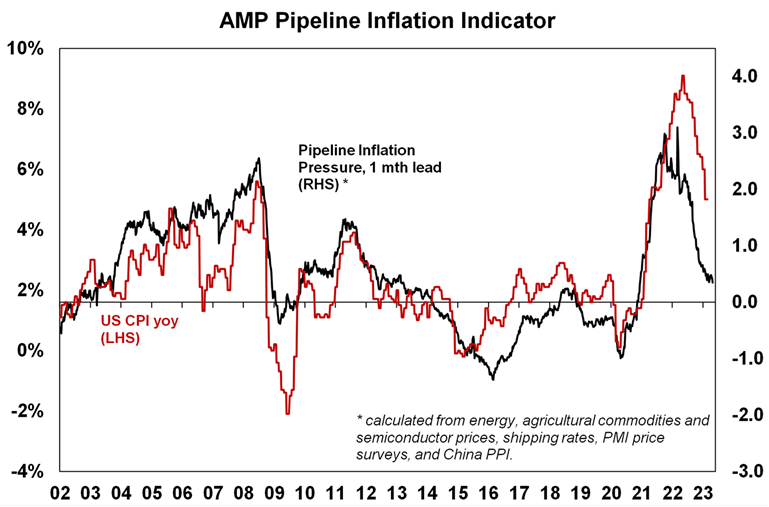

Still more central bank rate hikes, but at least the Fed is sounding a lot less hawkish. The Fed hiked by 0.25% taking the Fed Funds rate to 5-5.25% as expected, but it softened its tightening bias substantially – dropping its anticipation of more tightening and noting that it will closely monitor data and developments in determining the extent to which additional rate hikes may be required. This is similar to the language it used at the end of the rate hiking cycle into 2006. It’s prepared to do more but further tightening is no longer the default. With the Fed’s preferred yield curve now clearly flashing recession warnings, additional tightening coming from the banking stresses and inflation likely to slow (with our US Pipeline Inflation Indicator still pointing down for US inflation) our view is that the Fed has now reached the top and there is a high chance of easing by year end. This is in line with money market expectations.

Source: Bloomberg, AMP

The ECB slowed down to a 0.25% hike as expected taking its main refinancing rate to 3.75%, but its guidance on rates was hawkish with President Lagarde saying there is “more ground to cover” and the ECB accelerating quantitative tightening and taking no action to smooth a TLTRO (cheap bank funding) repayment cliff in June – implying a sharp withdrawal of cash from the Eurozone economy. This is all rather risky given the ongoing issues with bank stress.

The RBA raised its cash rate by another 0.25% taking it to 3.85%, surprising most economists including ourselves and the money market. We had thought that the decline in inflation and the absence of much new information since the last meeting would have seen the RBA pause for longer than one month. The RBA’s Statement on Monetary Policy didn’t make any major changes to its forecasts, but it did revise its forecasts for this year a bit to show: slightly lower GDP growth of 1.25% reflecting slower consumer spending and business investment; slightly higher unemployment of 4% partly due to stronger population growth; and lower inflation of 4.5% and trimmed mean inflation of 4% partly reflecting lower than expected inflation in the March quarter. In fact, its forecasts imply that trimmed mean inflation on a quarterly annualised basis will be back at the top of the target range next year. All of which could be interpreted as consistent with a less hawkish stance by the RBA than its currently communicating. Our assessment is that the RBA is underestimating the hit to consumer spending ahead – as revenge spending runs its course and as a significant proportion of home borrowers see prepayment buffers exhausted and with more than 15% of borrowers now set to see negative cashflow this year – and that this will drive a faster rise in unemployment and quicker fall in inflation than the RBA is allowing for.

As a result, we remain of the view that the RBA has done enough and that rates have peaked. However, so far we have been wrongly too optimistic on this and the risk of a further increase in rates remains very high given the RBA’s concerns about sticky services inflation (partly based on overseas experience), wages growth flowing from the tight labour market (not helped by the coming 15% rise in aged care wages), stronger population growth boosting housing related inflation (including for property prices which would reverse the negative wealth effect of falling prices) and the lower $A. Our concern though is that the jobs market and inflation are lagging indicators and the RBA is not paying enough attention to the way interest rate hikes hit the economy with a lag. This in turn runs the rising risk of knocking the economy into a recession. Interestingly, the money market (which was well ahead of most economists in anticipating rate hikes for last year) is pricing in close to a zero chance of another hike and a 100% chance of a cut by year end.

Coronavirus update

New global covid cases and deaths remain low – but there has been an increase in China albeit the numbers are low. New cases, hospitalisations and deaths in Australia are still trending up from their lows – but levels are still low.

Economic activity trackers

Our Economic Activity Trackers rose in the US and Australia over the last week but fell in Europe. Only the US is showing decisive weakness.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

US economic data was mixed again. Non-farm payrolls rose a stronger than expected 253,000 in April with unemployment falling back to 3.4% and wages growth picking up slightly to 4.4%yoy which will worry the Fed. However, prior months jobs growth was revised down leaving a downtrend in place for three-month average jobs growth, temporary employment which tends to lead fell again and other data showed rising jobless claims, another fall in job openings, quits trending down and layoffs trending up all of which points to a slowing jobs market even though its still tight. Both ISM business conditions indexes for April rose slightly but manufacturing conditions remain very weak. Prices paid rose but remain well down from their highs for both manufacturing and services and are bouncing around 2019/2020 levels.

Source: Macrobond, AMP

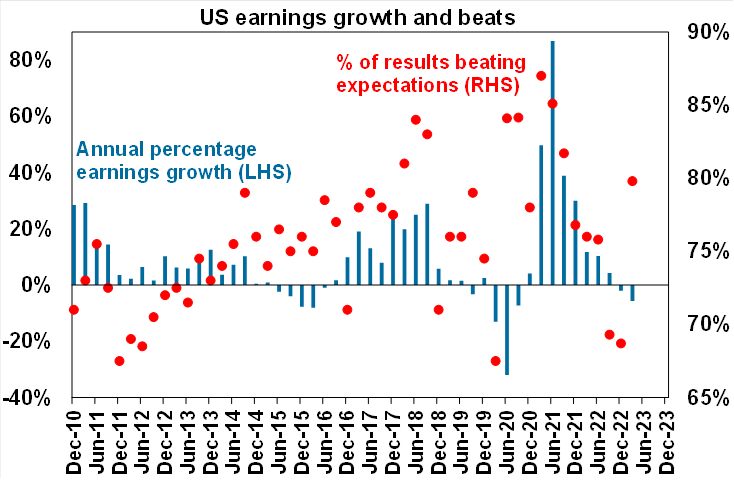

Continuing better than expected US earnings. 85% of S&P 500 companies have reported so far with 78% surprising on the upside which is far better than in the December quarter and above the long-term norm. The average beat is running at 7%. Consensus earnings expectations growth expectations for the quarter have risen from -6.2%yoy to -2.4%yoy, implying an actual rise in earnings in the quarter itself – but expect some renewed slowing ahead as growth and inflation slows. Non-US earnings growth is running around 11%yoy and beating consensus by around 13%.

Source: Bloomberg, AMP

Eurozone unemployment slipped to 6.5% in March. Meanwhile CPI inflation rose to 7%yoy but core inflation fell slightly to 5.6%yoy. The ECB’s March quarter bank lending survey showed very weak credit demand and tight lending standards albeit less tight than feared. Eurozone producer price inflation slowed to 5.9%yoy from 13.3%yoy.

New Zealand March quarter labour market data showed private sector labour costs up 4.5%yoy and private average hourly earnings up 8.2%yoy – both are well above wages growth in Australia & partly explain the greater aggressiveness of the RBNZ.

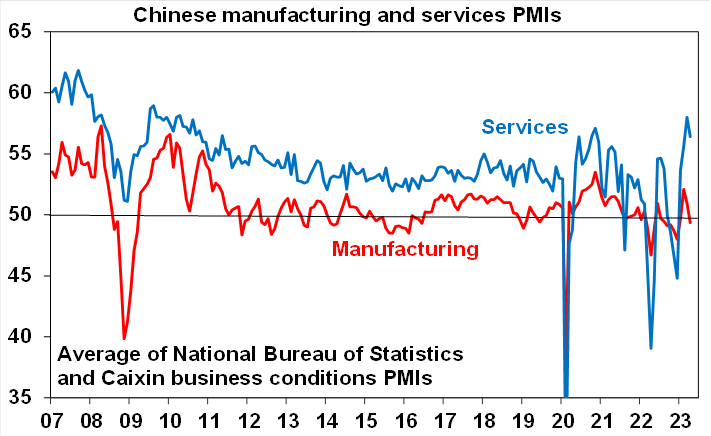

Chinese business conditions PMIs fell in April after their reopening driven rebound with manufacturing looking soft but services still strong.

Source: Bloomberg, AMP

Australian economic events and implications

Australian retail sales show further evidence of the rate hikes impacting. March retail sales rose a slightly stronger than expected 0.4%, but they have now been roughly flat in nominal terms since October despite high inflation which means they are falling in real terms and while spending on food and cafes is up non-food spending is down reflecting the hit from rate hikes to discretionary spending.

Per capita recession? Australia’s trade surplus rose to its second highest on record helped by a surge in iron ore exports. But for the quarter as a whole the strength was mostly price related with net export volumes looking like they will detract from March quarter GDP. With real retail sales also likely down in the March quarter it looks like being a tough quarter for GDP growth, with a high risk of a small contraction. With population growth around 2% and GDP growth this year of around 1% on our forecasts, it looks like we are sliding into another per capita recession with a high risk of a real recession.

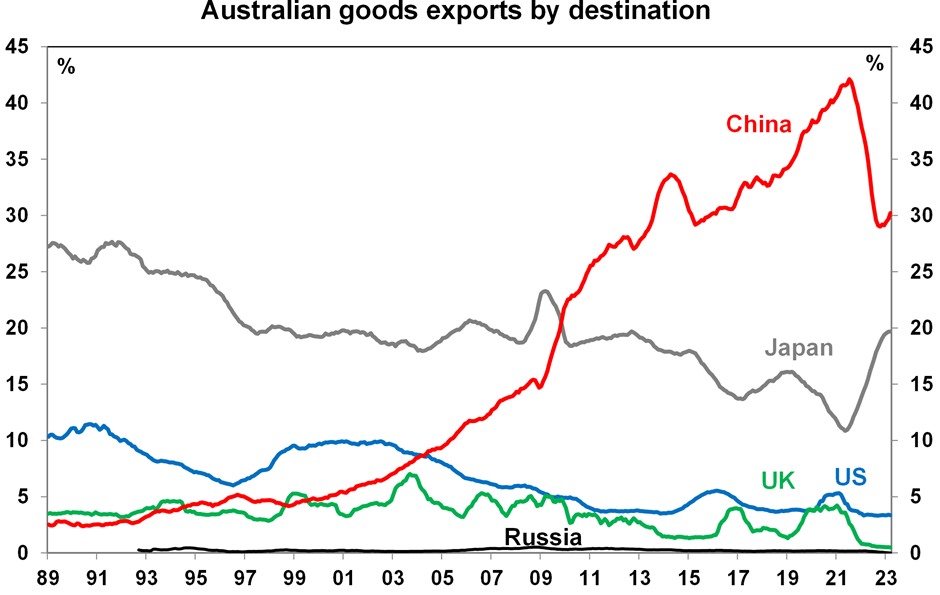

While exports to China have rebounded after their post 2020 hit its noteworthy that on a rolling 12-month basis they have fallen from over 40% of good’s exports to around 30% without much overall macro impact because many of our exports are fungible and were simply diverted elsewhere, eg Japan. Interestingly Russia has gone from nearly nothing to nothing.

Chart shows rolling 12 month percentage share. Source: ABS, AMP

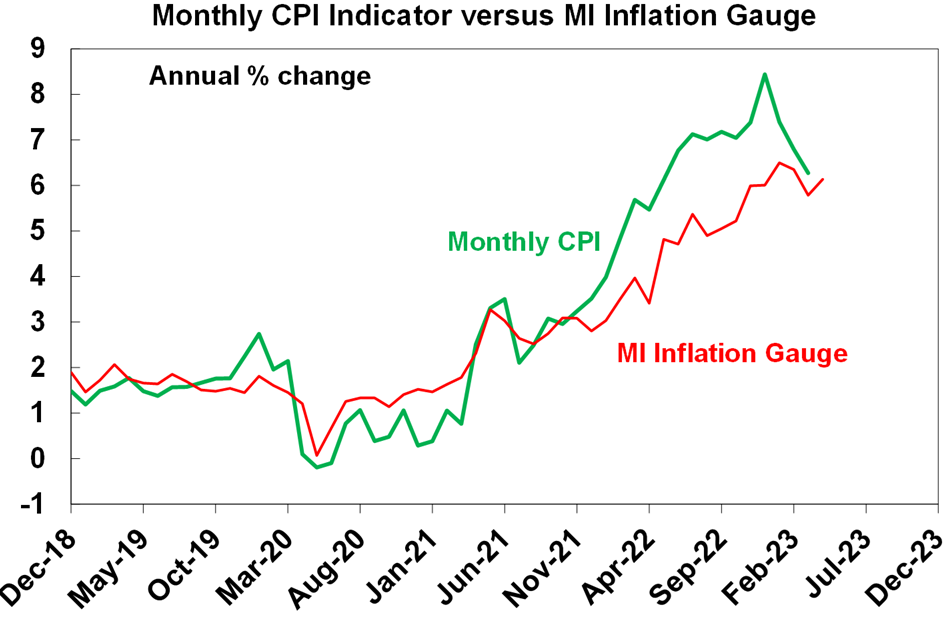

Inflation as measured by the Melbourne Institute’s Inflation Gauge slowed to 0.2%mom in April, but rose to 6.1%yoy. It looks to be peaking but it lagged the ABS measures on the way up.

Source: ABS, Melbourne Institute, AMP

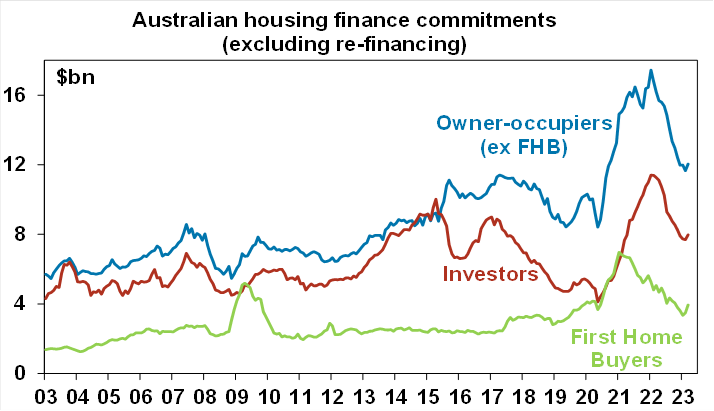

Home prices up again in April with an intensifying supply shortfall, but still rising interest rates pose a major threat. CoreLogic data showed a second month of gains in average home prices consistent with stronger auction clearance rates and an upturn in housing finance commitments which rose 4.9% in March.

Source: ABS, AMP

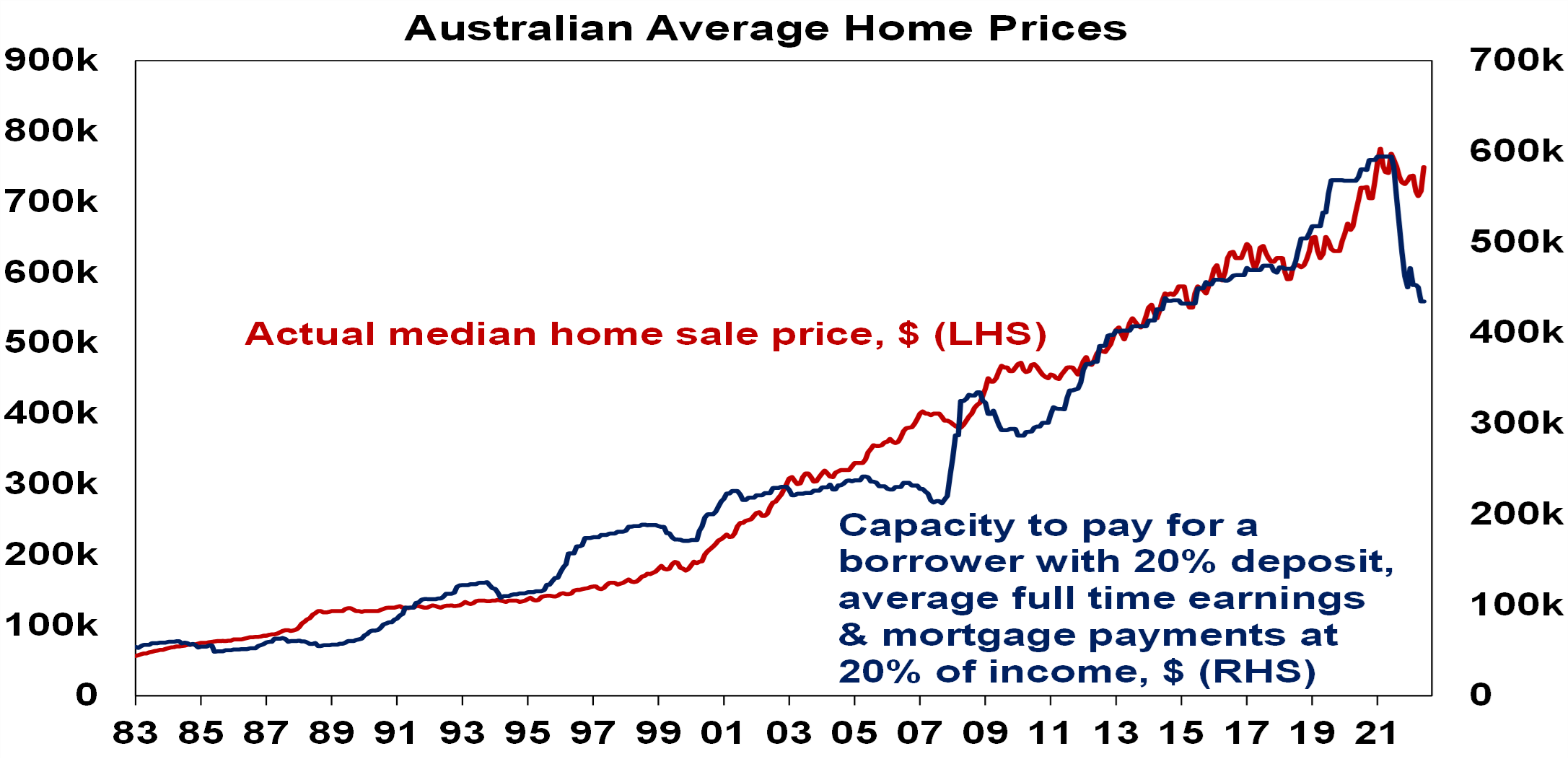

Surging demand associated with the rebound in immigration and very constrained supply possibly aided by perceptions that interest rates had peaked appear to be dominating the impact of higher interest rates – for now!. As a result, we have revised up our property prices forecasts to flat to up slightly for this year. However, this is not something I feel particularly confident in given the pain ahead from high interest rates both directly via higher debt servicing costs and indirectly via the flow on to higher unemployment. The latest interest rate hike – particularly with the RBA citing rising home prices as a factor in its decision to hike again this month – just adds to the uncertainty and runs the risk that buyers will lose faith with the “interest rates near the top” view and go back to the sidelines. The latest rate hike is resulting in another leg down in home buyers’ capacity to pay – the gap between the red and blue lines in the next chart will need to eventually correct one way or the other, ie, via lower prices or much higher incomes and lower mortgage rates.

Source: RBA, CoreLogic, AMP

What to watch over the next week?

In the US, April CPI inflation (Wednesday) is likely to be unchanged at 5%yoy as higher gasoline prices impact but core inflation is expected to slow a bit to 5.5%yoy from 5.6%. Producer price inflation (Thursday) is expected to slow further to 2.5%yoy. The Fed’s Senior Loan Officer Opinion Survey (Monday) is likely to show a further tightening in already tight bank lending standards. The NFIB small business survey comes out Tuesday.

The Bank of England (Thursday) is expected to hike rates by another 0.25% to 4.5% and provide neutral guidance.

Chinese April trade data (Tuesday) is expected to show slower export growth of 11%yoy and an improvement in imports to flat year on year. CPI inflation (Thursday) is expected to slow further to just 0.2%yoy with producer price inflation falling to -3.1%yoy.

In Australia, the focus will be on the 2023-24 Australian Budget (9 May) which is likely to be mainly about modest cost of living relief, and measures to fund a further ramp up in structural spending pressures (on NDIS, debt interest, aged care, health and defence). Key features are likely to be:

- minimal cost of living measures for low to middle income workers (with energy, medicine bill relief & possibly more rental assistance) and a modest increase in Jobseeker for over 55s;

- a ramp up in defence spending on missiles and submarines;

- increased spending on aged care partly flowing from a 15% pay rise for aged care workers which will cost $14bn over four years;

- possible measures to reduce the structural budget deficit (which is around $50bn or 2% of GDP) with a combination of tax increases (including an overhaul of the Petroleum Resource Rent Tax, maybe a further cut to tax concessions and possibly a wind back of the Stage 3 tax cuts) with possible spending savings (like limiting growth in the NDIS, increasing deeming rates to limit pension payments & cutting middle class welfare);

- some measures to help boost housing affordability – including tax changes to encourage build-to-rent housing;

- a ban on some vaping with increased tobacco tax;

- measures to support impact investing to tackle social problems;

- net immigration of 400,000 this financial year up from a forecast of 235,000 in the October Budget, taking population growth above 2% for the first time in 14 years;

- improved budget balances thanks to higher commodity prices and stronger personal tax collections in the short term and stronger population growth, somewhat higher bulk commodity price assumptions and budget savings longer term resulting in improved budget balances. With March budget data showing a small surplus over the past 12 months it’s likely the budget balance for 2022-23 will show a small surplus possibly around $2bn (compared to a $36.9bn deficit projected in the October Budget). Some of this improvement will carry into 2023-24 where we expect a deficit of $25bn (down from $44bn forecast in October) with a 2024-25 deficit of $40bn; and

- the 2023-24 GDP growth forecast may be revised down to around 1.25% from 1.5

On the data front in Australia, expect a 1% fall in building approvals (Monday), March quarter real retail sales (Tuesday) to fall around 0.5%qoq and consumer sentiment (Tuesday) to reverse its RBA rate pause inspired 9.4% gain in April following the rate hike this month. The NAB business survey for April will also be released on Monday.

Outlook for investment markets

The next 12 months are likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but stronger than feared. This along with improved valuations should make for reasonable share market returns this year in contrast to 2022. But the next few months may be rough given high recession and earnings risks, uncertainty around US banks and raising its debt ceiling, geopolitical risks and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we have revised up our national average home price forecast for this year from a fall of -7% to around flat to up slightly ahead of 5% growth next year. However, the risk a further leg down putting us back on track for a 15-20% top to bottom fall on the back of the impact of high interest rates and higher unemployment are very high (at around 45%) with the latest RBA hike adding to that risk.

Cash and bank deposits are expected to provide returns of around 3.5%, reflecting the back up in interest rates.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.